Beyond ReelShort: What Its “Parent” Is Really Building in Global Short-Drama

If you treat ReelShort as just one hit app, you’re missing the bigger play. Behind ReelShort’s operator, Crazy Maple Studio (CMS), stands COL Group—a company stitching together a global short-drama business with a multi-app portfolio, region-by-region operations, and a library it can sell wholesale.

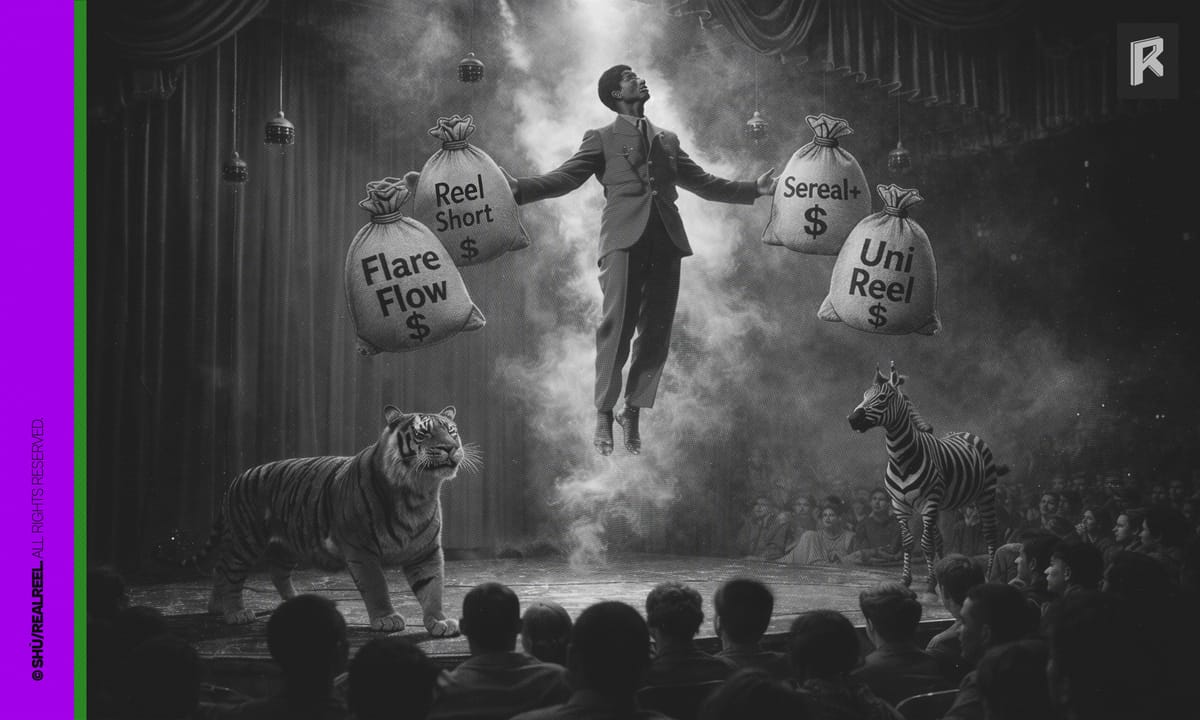

First, the relationships. Public filings show COL holds 49% of CMS. CMS has operated independently since 2023, which is why people casually call COL the “parent” behind ReelShort even though it’s technically a major shareholder, not the owner. What matters for creators: while CMS runs ReelShort, COL itself is simultaneously pushing three lines internationally—

FlareFlow (global), Sereal+ (multi-language with a Southeast Asia tilt), and UniReel (Japan-first). Together with ReelShort, those four names outline COL’s real map.

The accelerator right now is FlareFlow. Launched this spring, it briefly topped the U.S. App Store and Google Play entertainment free charts Sept. 23–25 and has shown momentum in markets like Germany, Australia, and Canada.

By contrast, Sereal+ pulled back on user acquisition in late July, with downloads and rankings easing as a result. In Japan, UniReel has stayed steady: last year COL JAPAN helped form a short-drama committee with LINE Yahoo, Hakuhodo, and HUUM, and the app jumped into the iOS entertainment charts its launch week.

Under the hood, COL is turning content into something it can wholesale.

In mid-August the company set up a global distribution unit to license 1,000+ bilingual titles to broadcasters, streamers, and telcos. Translation: it’s not only building consumer apps; it’s also becoming a B2B supplier that can push its library into wider pipes.

For creators, the immediate takeaway is capacity and demand are both scaling. Looking at 2025–2026, FlareFlow has floated output targets around ~100 originals this year, ~180 next, anchored by dual hubs in mainland China and Los Angeles. And as a playbook, ReelShort’s model: 60–90 episodes per title, budgets around ~$300K, has already standardized the assembly line for “short runtime + dense hooks.”

Growth mechanics matter just as much. FlareFlow’s rise isn’t a pure “buy your way up the charts” story. Its UA play leans on emotion-forward, full-scene clips used directly in cold-start ads, then fanned out across languages. That explains why it scaled in English markets and in German/Japanese/Spanish/Portuguese at the same time, and why Sereal+, built around an IAP-heavy phase, chose to throttle spend and shift resources toward a product with greater cross-language upside. Practically, this favors projects that deliver portable hooks, a clear reversal inside ~60–90 seconds, and modular scenes that cut cleanly for creatives.

Now the opportunity and the catch.

COL’s matrix links ReelShort (equity sample) → FlareFlow (global flagship) → UniReel (Japan local) → Sereal+ (multi-language long tail) into a pipeline that can self-operate and also distribute. If your concept can travel across languages and your team can turn scripts and ad creatives around in 3–5 days, you’re easier to onboard. The risk is equally plain: IP and originality are the hard lines. The summer’s debates around ReelShort were a reminder: your pitch needs proof of originality and a clean adaptation chain, or you won’t make the A-list.