US Micro-Drama Check-In:DramaBox wants the crown, local media is finally paying attention, and the…

Latest News About Vertical Micro Drama Industry

DramaBox says it wants to be number one in the United States

Business Insider sat down with DramaBox and the message was blunt. The company wants to be the top micro-drama platform for American users. To get there, it is widening beyond billionaire romance and werewolves into family viewing, choose-your-own-adventure formats, and kids animation. It is also opening a New York office, exploring product placement, and keeping the weekly sub price around twenty dollars. Sensor Tower puts its lifetime in-app revenue at about four hundred and fifty million dollars as of March, just behind ReelShort, though DramaBox says its internal number is higher.

Why this matters to creators here. A platform declaring it wants to be first in the United States usually precedes a hiring and commissioning sprint. If DramaBox starts sourcing more US-made shows while keeping per-project budgets efficient, that is real oxygen for writers and producers who can deliver strong hooks and volume.

US media is now explaining the format to mainstream readers

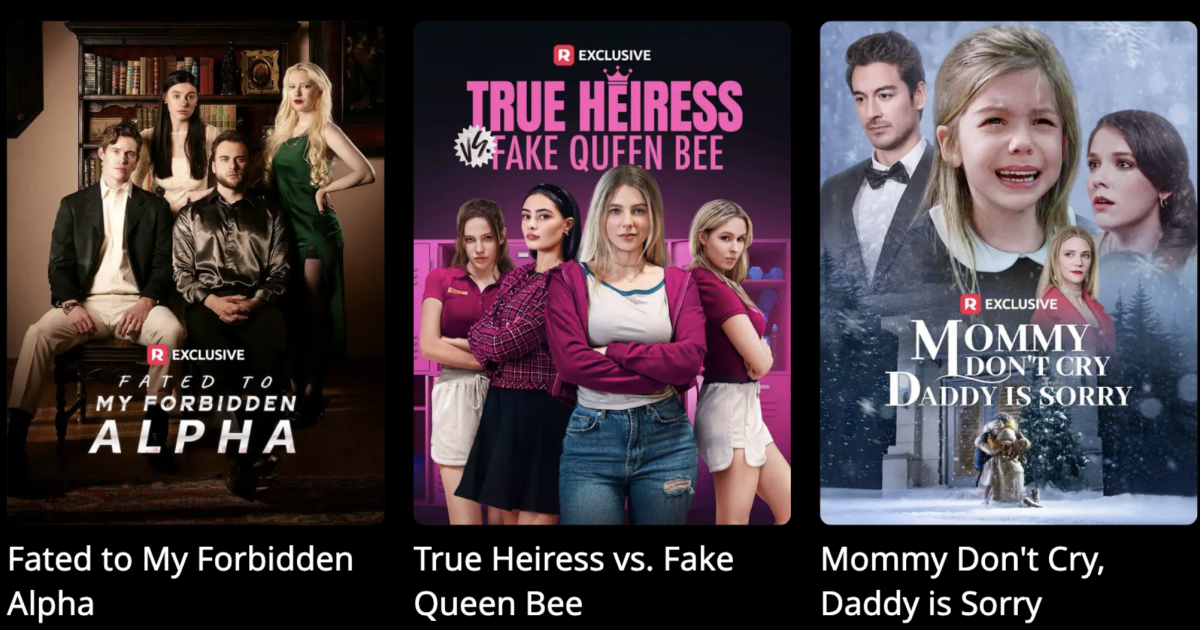

LAist published a plain-language explainer that does a lot of industry PR for you. It tells Hollywood readers what a micro-drama is, that episodes are one to two minutes, series often run twenty to one hundred episodes, and that people binge them on dedicated apps like ReelShort and DramaBox. It also notes the revenue surge from early 2024 to early 2025, which helps normalize the business for traditional crews and executives.

National outlets are piling on. The Washington Post framed these shows as spicy and pricey vertical mini-dramas that are taking over streaming attention, with subscription stacks that can add up fast and with cliffhanger engineering built for phones. Whether you agree with the tone or not, this is the kind of coverage that moves the format from curiosity to category.

The macro picture is getting hard to ignore

Two things can be true at once. Official data in China said overseas short-drama apps have now passed three hundred, with global cumulative downloads over four hundred and seventy million. That stat captures the breadth of the ecosystem and helps explain why every tool vendor suddenly has a “short drama” deck.

Sensor Tower’s global roll-up tells an even bigger story on spend. In the first quarter of 2025, in-app purchases for short-drama apps approached seven hundred million dollars, almost four times the first quarter of 2024. It also pegs lifetime global in-app revenue around two point three billion dollars by March and nearly nine hundred and fifty million cumulative downloads, with the United States contributing about half of Q1 revenue. Different methodology, same conclusion. This is not a fad.

The go-to-market playbook is getting formalized

On September eleven, TikTok for Business ran its second Short-Drama Go-Global Conference in Beijing. The headline takeaway was a phased roadmap from cold start to long-term operation, plus the claim that the overseas short-drama market could top three point two billion dollars by the end of 2025 with audiences across more than eighty countries. For teams building for export, this is a direct line into traffic, targeting, and monetization thinking from the platform that still moves culture.

What this means for your next move

If you are an indie US creator, alignment is getting easier. Platforms want local stories that still feel bingeable at ninety seconds a beat. Media now understands what you are pitching. And the spend is finally visible in public data. Package your project like a product: a crisp premise trailer, a season arc that can export as ads, and three sample episodes that prove your hook lands by second ten. Then choose your door. DramaBox if you want fast iteration with a team that is hiring in New York. TikTok for Business if you want the user-acquisition machine and a structured plan from pilot to payback. The window is open right now because the market is big enough to matter and small enough that new voices can still change the leaderboard.