Vertical Drama Weekly: Vertical Becomes Policy, IP, and Platform Strategy

✱

Over the past week, vertical drama continued its quiet shift from platform experiment to industry structure, driven not by a single breakout title but by coordinated moves across policy, production, IP strategy, and audience behavior — all reinforcing that vertical storytelling is no longer peripheral to the entertainment economy.

Week of Jan 25–31, 2026

Join Real Reel

Los Angeles explores a $5M micro-drama production subsidy

Los Angeles City Council has voted to explore a $5 million subsidy program specifically targeting micro-drama production, including development support, workforce training, and local production incentives. While details are still under review, the proposal explicitly frames vertical and short-form scripted content as an emerging production sector worthy of municipal backing.

This marks one of the first times a U.S. city has publicly considered policy-level support for vertical storytelling, rather than treating it as a purely platform-driven phenomenon.

This signals the first step toward treating micro-drama as a recognized production category within U.S. local film economies, not just a platform-driven content format. If formalized, it could influence labor classification, incentive eligibility, and long-term production geography for vertical content.

Fox deepens its vertical bet with Dhar Mann Studios

Fox Entertainment’s multi-year deal with Dhar Mann Studios — covering the production of roughly 40 scripted vertical series — continued to gain industry attention this week. The partnership combines Fox’s production and distribution infrastructure with Dhar Mann’s audience-first storytelling engine, aiming to supply vertical platforms with consistent, scalable scripted output.

This isn’t an experimental pilot slate. It’s a volume commitment.

Fox’s commitment reframes vertical drama as a supply-chain problem rather than a content experiment — prioritizing volume, reliability, and audience predictability. This is closer to a television commissioning mindset than a creator marketplace model.

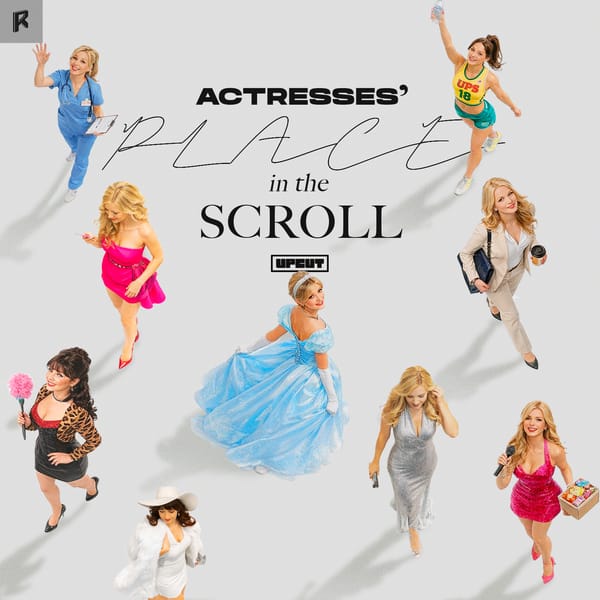

Micro-drama content faces its first mainstream backlash

As micro-drama revenues climb in the U.S., Business Insider reports growing criticism around content excesses — including violence, humiliation tropes, and gender stereotyping used to drive rapid engagement and in-app purchases. At the same time, newer platforms and creators are experimenting with alternative tones, stronger character arcs, and less shock-driven storytelling.

The conversation has shifted from “does it work?” to “at what cost?”

Backlash indicates that micro-drama has crossed from growth phase into reputational risk management, where platforms and producers must balance monetization mechanics against brand positioning, advertiser comfort, and long-term audience trust.

Audience data clarifies who micro-drama is really for

New reporting highlights how U.S. micro-drama consumption is being driven less by teens than by 35–54-year-old viewers, particularly women, drawn to escapist genres like fantasy, mafia romance, and revenge narratives. Actor-fan interaction, rapid cliffhangers, and frequent updates remain central to retention and monetization.

This audience profile increasingly challenges assumptions about who vertical storytelling serves.

The emerging audience profile challenges the assumption that vertical storytelling is youth-led, reframing it instead as a midlife, habit-driven consumption product — with implications for casting, narrative pacing, and retention-focused writing strategies.

Classic IP enters the vertical era

UK-based platform Tattle TV released a vertical micro-drama adaptation of Alfred Hitchcock’s The Lodger, re-editing the classic film into episodic, mobile-native segments monetized via subscriptions and virtual currency.

The experiment sparked debate around framing, pacing, and cinematic integrity — but it also demonstrated that vertical storytelling is being tested as a secondary life cycle for existing IP.

Vertical adaptation of legacy IP introduces a new secondary exploitation window — one that prioritizes mobile-native engagement over cinematic preservation, and raises questions about rights packaging, creative control, and value extraction from back catalogs.

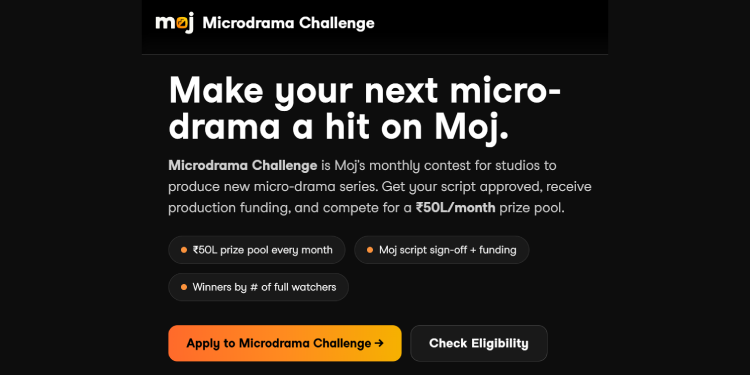

India’s Moj launches a funded Micro Drama Challenge

Indian short-video platform Moj announced a ₹20 crore (≈$2.6M) annual Micro Drama Challenge, offering funding and structured support to micro-drama creators. The program positions vertical storytelling not just as content, but as a talent development pipeline.

While regionally focused, the initiative reflects how Asian markets are formalizing creator ecosystems around vertical narrative.

Structured funding programs suggest a shift from creator discovery to ecosystem engineering, where platforms actively shape production norms, talent pipelines, and content standards — accelerating professionalization rather than relying on algorithmic emergence.

✱

![Vertical Drama Weekly: Netflix, Tiktok, and the money […]](/content/images/size/w600/2026/01/Image_20260124104344_565_26.jpg)