Vertical Dramas Will Eat Hollywood’s Lunch

“Over my morning commute I binged nine episodes, watched a billionaire’s wife fake her own death, and it only cost me 27 cents.” —…

“Over my morning commute I binged nine episodes, watched a billionaire’s wife fake her own death, and it only cost me 27 cents.”

— ReelShort user review, Los Angeles

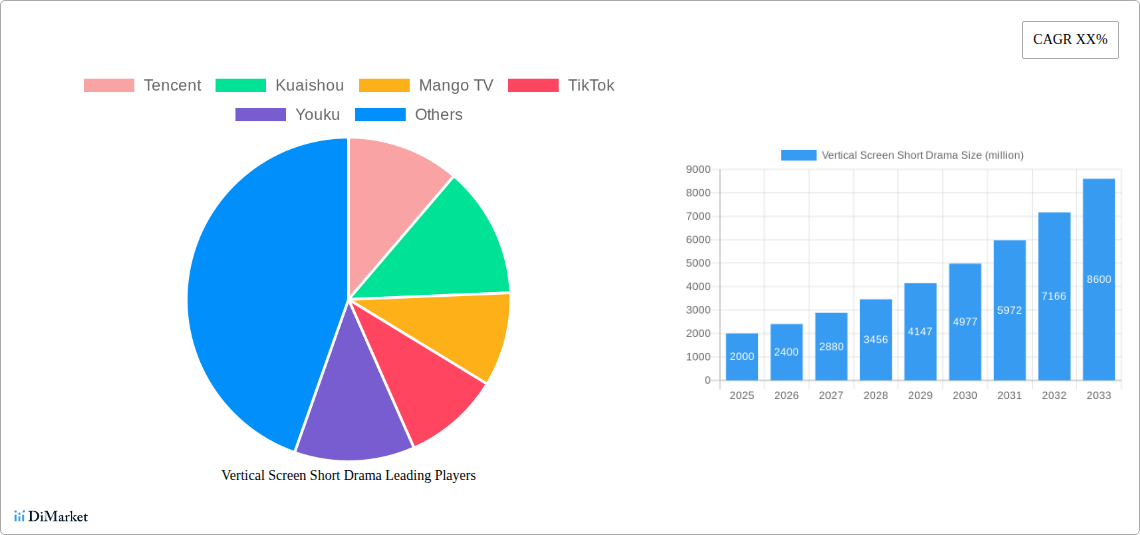

China’s micro‑drama market hit ≈ US$6.9 B in 2024, bigger than its domestic box‑office. ReelShort’s U.S. installs jumped 992 % in a year. This is a new medium with Candy‑Crush economics and Netflix‑level engagement, and it’s coming for Hollywood’s lunch money.

The US $6.9 B Shockwave

In December 2024, the China Association of Performing Arts announced that 微短剧 (vertical or “micro” dramas) generated ¥50.44 billion (≈ US$6.9 B), eclipsing the entire mainland theatrical box‑office for the first time.1 That single stat rewrites the global content map:

· Growth: 34.9 % YoY, faster than TikTok’s peak expansion.

· Volume: > 3,000 new series green‑lit in 2024 alone.

· Cost: $3–6 K per 60‑episode season, about the price of craft services on an indie feature.

Data bomb: one‑minute episodes, thirty cents a pop, US$5 billion in annual gross. This isn’t a side gig, it’s the main event.

China’s streamers call it “影视工业化 2.0” (Film and Television Industrialization 2.0), a factory model where script, shoot, and post collapse into a 7‑day sprint. Hollywood hasn’t seen a curve this steep since Netflix’s 2011 pivot to streaming.

Money flows to speed: the medium with the shortest production cycle wins the next audience cohort. If a phone‑native format can out‑gross cinemas in China this year, it can under‑price and out‑scale cable dramas in the U.S. next year.

This Is NOT TikTok

Scrolling TikTok is a habit loop; vertical drama is an appointment. They may look identical in native 9:16 video, but their mechanics diverge:

TikTok Clip: Stand‑alone joke/dance; no specific season/length; Monetize with Ads & brand‑deals

Vertical Drama: 60‑sec episode w/ hard cliff‑hanger; 60–80 eps (≈ 1 feature); Freemium → coin unlock → gacha spin

Think Candy Crush meets telenovela: players watch 5 free levels, then pay coins to skip a wait timer. The paywall converts emotion into micro‑transactions at a 3 ¢ price point that feels like “free, but faster.”

Engineering teams tag every episode at second‑levels; retention spikes if the freeze‑frame lands between s 55–58. Writers now write to the second, not the page. A/B testing thumbnails can lift funnel conversion by 18 %. Storytelling just became a data science discipline.

ReelShort’s Beach‑head in America

ReelShort, Crazy Maple Studio’s flagship app, jumped from 3.4 M installs in Q1 ’23 to 37 M in Q1 ’24 (a 992 % surge). In May 2025 it briefly dethroned TikTok atop the U.S. App Store entertainment chart.

Mainstream media finally blinked:

· Business Insider calls them “soapy, low‑cost mini‑dramas printing money.”

· CAA’s digital strategy deck (seen by this author) labels the format “next‑gen talent incubator.”

Translation: Hollywood’s powerhouse agencies are already tracking “micro‑drama casting” in internal emails. Money can smell the opportunity.

Why VCs Should Drop Everything

CAC arbitrage: Appfigures tracks 215 short‑drama apps in the U.S. grossing > US$100 M/month. Most acquisition comes from TikTok Spark Ads that splice 15‑sec cliff‑hanger teasers, piggy‑backing on user‑generated traffic instead of buying TV spots.

IP flywheel: A $400 K‑budget season that tests well can be optioned into a $40 M feature or series, reversing the Marvel pipeline: audience first, cinematic universe later.

The Gen Z female gap: 65 % of ReelShort payers are women 18‑29. U.S. linear TV offers them no phone‑native fiction besides Instagram Reels. Whoever owns this demo owns the next decade of licensing.

From Data Hack to Story Stack

Today’s vertical‑drama leaders are still data‑first tech outfits: engineering crews A/B test cliff‑hangers, gamify coin funnels, and iterate scripts on 24‑hour loops. The model blitz‑scales CAC efficiency, yet it rests on shaky ground, union backlash over New Media rates, content fatigue from endless billionaire‑soap tropes, and dependence on Chinese web‑literary IP conventions that don’t always translate.

The next growth curve belongs to companies that graft guild‑savvy, original creators onto this pipeline. Professional showrunners who can diversify genres, build globally licensable characters, and negotiate fair labor frameworks will turn the format from a metrics hack into a durable story business. In short: move from algorithmic content to content‑native algorithms, and claim the real edge.