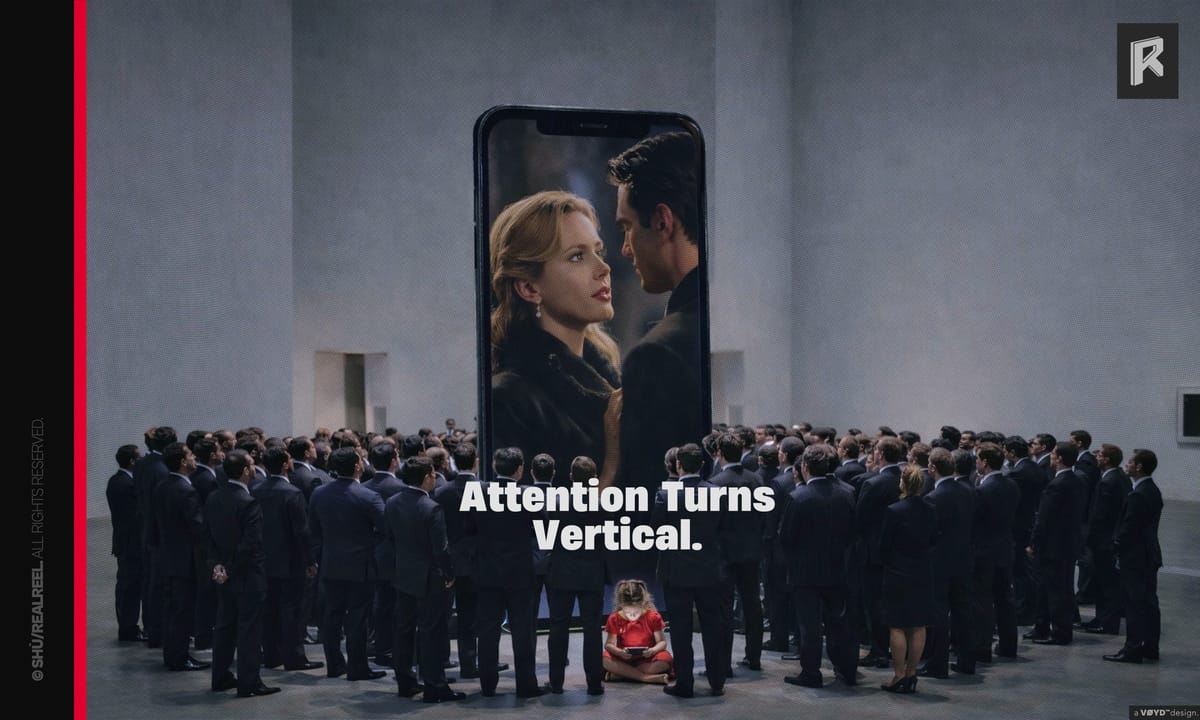

What the World Is Actually Watching in 2025’s Vertical Micro Drama Boom

✱

Two things can be true at once: micro-dramas are still scrappy, and they’re already big business.

Week of Oct 3– Oct 10, 2025

Join Real Reel

Outside China, the format generated about $1.4B in 2024 and is forecast to hit $9.5B by 2030

a curve steep enough to make every studio, streamer and creator pay attention.

This year the spend only accelerated. Multiple trackers peg 2025’s global (ex-China) market at ≈$3B, with the U.S. alone crossing ~$1.3B, driven largely by pay-to-unlock episodes after a few freebies. Meanwhile, Q1 2025 in-app purchases across short-drama apps neared $700M, roughly 4× the prior year’s quarter. Translation: this isn’t a fad; it’s a new habit.

Who’s watching, and where the growth is coming from

The audience skew is real: mobile-first women make up a heavy share of paying viewers, which aligns with how the top apps program (romance, revenge, fantasy). That profile showed up early around ReelShort and hasn’t disappeared as the category widened.

Regional heat: in Latin America, short-drama downloads grew ~69% QoQ in Q1 2025, with fast-rising newcomers vaulting into the charts. Expect this to be one of the most competitive UA battlegrounds through year-end.

Japan is lining up as the largest APAC market outside China on a longer horizon (to 2030), and India is lighting up with new funding, partnerships and local platforms, signs the playbook is moving beyond simple translation.

The platform race: two leaders, many feeders

ReelShort and DramaBox still set the pace. As of March 2025 they’d generated roughly $490M and $450M in lifetime IAP respectively; in Q1 2025 alone they hit $130M and $120M. DramaBox disclosed $323M revenue and $10M net profit in 2024; reporting around ReelShort suggests ~$400M 2024 revenue at greater scale.

Distribution is a patchwork: apps monetize; TikTok, YouTube Shorts and Reels drive discovery and retargeting. DramaBox is actively broadening beyond billionaire romances into family, kids and choose-your-own formats, while ramping U.S. production — signal that content breadth (not just UA muscle) will decide the next phase.

Why the pipelines are faster this year

Two words: AI assist. Tools like Runway Gen-3/Gen-4 tightened previz, pickup shots and localization passes — less “one-click filmmaking,” more time shaved between drafts and dailies. Creators cite better shot control and character consistency, which matters when you’re shipping 60–90 episodes at 60–90 seconds each.

The economics that follow are straightforward: lower per-minute cost, more A/B room for endings and ad creatives, and faster local remakes of proven story loops. That’s exactly how apps can test a revenge arc in Mexico City on Monday and push a tweaked cut in Manila by Friday.

Friction points you shouldn’t ignore

Piracy & plagiarism are the industry’s open secret. Reports of thousands of pirated links per series and public IP theft accusations (including claims against ReelShort this summer) underline how fragile the moat is when episodes are minute-long files. Expect sharper watermarking, faster takedowns, and eventually case law.

Content sameness is the other tax. The category monetizes cliffhangers, but over-reliance on the same CEO-alpha/werewolf tropes caps LTV. That’s why you’re seeing platforms court animation, male-skew stories and interactive branches, to widen the TAM without abandoning the “tap to unlock” loop.

The 2025–26 outlook (and what to do about it)

- Money follows loops that travel. Outside China, the market is on a path to multi-billion by decade’s end; the winners will package repeatable story engines with local production muscle. If you’re a studio, pair one global IP archetype (revenge, hidden identity, time-slip romance) with country-specific casting and props, not just dubbing.

- Bet on LATAM & India for growth, the U.S. for ARPPU. The U.S. is already >$1.3B this year; Latin America is compounding fast on the installs side; India is building a supplier base and funding stack that didn’t exist in 2023. Structure slates accordingly.

- Treat AI as a speed layer, not a taste layer. Use Gen-3/Gen-4-style tools to compress cycles and versioning, but keep human editors in the loop for cultural reads and comedic timing. That’s where churn gets fixed.

- Design for the funnel you actually have. Your “episode 1–5 free, 6 costs” conversion is a product problem, not just a media buy. Build two endings (soft/hard cliff), instrument drop-offs at the beat level, and push the higher-retention version to paid cohorts.

By the numbers (quick read)

- $1.4B (2024) → $9.5B (2030) ex-China: the macro forecast that set off the land-grab.

- ≈$3B (2025) ex-China; ~$1.3B U.S.: where the money is this year.

- Q1 2025 IAP ≈$700M across short-drama apps; downloads up to ~259M: this is supply and demand.

- ReelShort / DramaBox lifetime IAP: $490M / $450M as of March; Q1 2025: $130M / $120M.

- DramaBox 2024: $323M revenue, $10M profit; ReelShort: reports point to ~$400M revenue.

Bottom line

Vertical Micro dramas aren’t replacing TV or film; they’re annexing the minutes between everything else and charging rent on emotion.

The play now is simple and hard: ship faster, localize smarter, stretch beyond two or three tropes, and protect your IP as if your CAC depends on it. Because it does.

✱