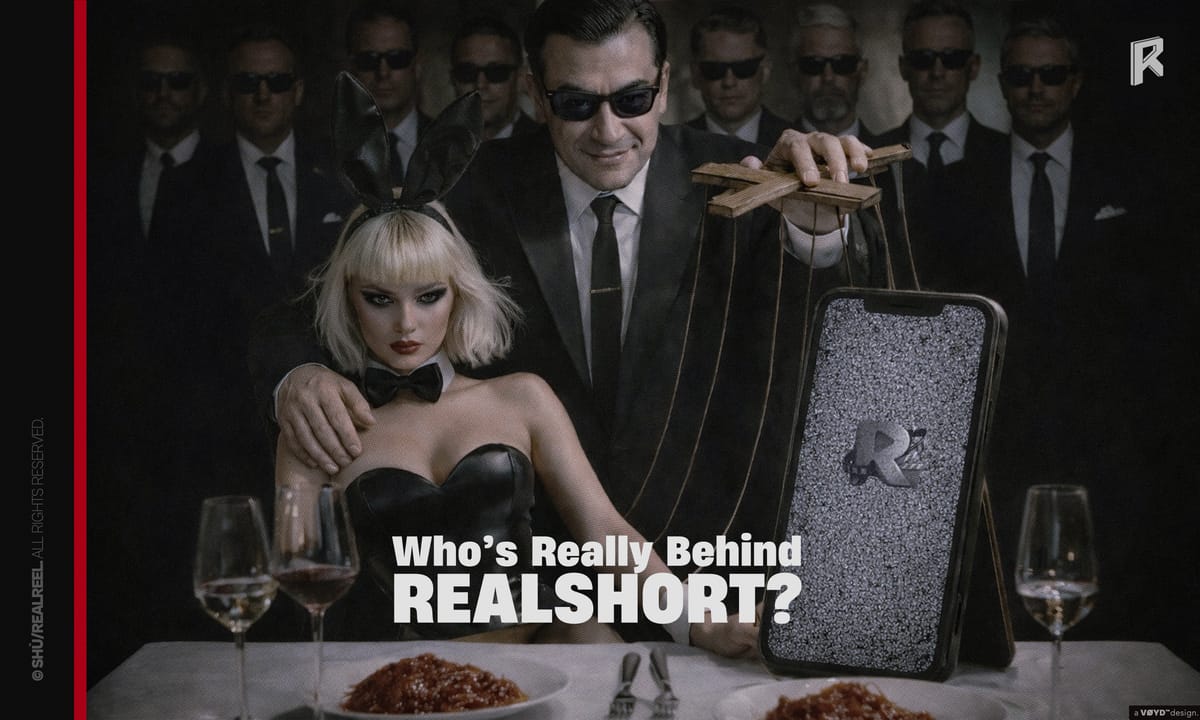

Who’s Really Behind ReelShort? Why they can make $30M+ a Month in 2025?

From a 20-square-meter dorm office in Beijing to the top of the U.S. App Store. Here’s the cross-border thriller powering your 60-second cliff-hangers.

In 2000, a handful of recent grads from Tsinghua (China’s top 1 university) crammed into a broom-closet office in Beijing’s Haidian startup district and launched Chinese Online (COL). Their first play was almost cheeky: convert pirated web novels into paid PDFs.

The idea snowballed. By 2010 COL’s portals (17K.com and others) hosted 5.6 million titles and 45 million registered authors, enough IP to bury a small nation.

When the company rang the bell on the Shenzhen Stock Exchange in 2015, reporters hailed it as “China’s first pure-play digital-publishing stock.”

COL even dabbled in selling translated stories on Kindle, but overseas royalties were pocket change.

In 2016 COL’s execs went west. They incorporated Crazy Maple Studio (CMS) in California’s Bay Area with a mandate to “turn stories into games, then games into cash.”

One year later, October 2017 , CMS dropped Chapters: Interactive Stories, a choose-your-own-rom-com app that cracked the U.S. visual-novel TOP FIVE within two months and delivered COL its first serious foreign revenue.

Fast-forward to 2021: China’s one-minute, TikTok-style dramas are exploding. CMS founder Joey Jia asks, “What happens if we stick that 30-cent paywall in front of Western viewers?”

Armed with a mountain of proven IP from Chapters, CMS green-lights Project ReelShort in February 2022; by August a stealth beta is already live on Google Play.

At first glance it looks like a textbook Silicon-Valley fairy tale — until you check the cap table. COL owned 100% of CMS until late 2021, when it diluted to 49 % (just ahead of ReelShort’s birth) to give the studio more fund-raising freedom.

The bet paid off fast: in November 2023 ReelShort’s Fated to My Forbidden Alpha shot to #1 on the U.S. iOS Entertainment chart and doubled COL’s share price in two weeks.

By May 2024 TIME had named Crazy Maple one of the world’s “Most Influential Companies.” ⇲

It isn’t just an app — it’s a trans-Pacific conveyor belt that turns Chinese IP into American micro-binges (and sometimes back again).

How ReelShort Climbed to $33M a Month?

Just months before ReelShort’s green-light, in Q4 2021, COL sliced its ownership of CMS from 100 % down to roughly 49 %. The partial spin-out let the U.S. unit court dollar investors and insulated COL’s earnings report from the burn that was about to come.

When ReelShort’s first runaway hit (Fated to My Forbidden Alpha) shot to #1 on the U.S. App-Store entertainment chart in November 2023, COL’s Hong Kong–listed shares doubled in two weeks. An instant, headline-grabbing feedback loop that funneled fresh capital and credit lines back into CMS.

The new money went straight onto soundstages. By mid-2024 CMS was running 15 production pods in Los Angeles, Manila and Mexico City, each shooting 70–90 script pages in five days. Lean crews, non-union day-players, and recycled standing sets keep season costs in the US $250–300 K band. That means a single U.S. user who binge-spends US $20 covers roughly four seconds of screen time; a hit with half a million payers clears break-even in under a week.

The playbook mirrors mobile-game live-ops: writers upload three alternate endings, marketing A/B-tests thumbnails overnight, and the best-retaining branch becomes canon the next morning.

Five, or sometimes ten, free episodes lure viewers into the cliff-hanger loop; Episode 6 costs 30 ¢ or a rewarded-video ad. In mid-2024 ReelShort added a gacha-spin “lucky wheel,” boosting first-week ARPPU by roughly 13 % according to internal UA decks shared with partners. Last month Sensor Tower pegged ReelShort’s consumer spend at US $33 million on four million downloads: an ARPDAU that rivals mid-tier match-three games.