India’s Vertical Short Drama Hit #1, But Can They Make Money?

In July, India quietly became the world’s #1 market for short-drama app downloads, racking up 21.07 million installs in a single month. All…

In July, India quietly became the world’s #1 market for short-drama app downloads, racking up 21.07 million installs in a single month. All four of the top download spots inside India went to homegrown apps, with Kuku TV jumping to #3 globally, just 1.16 million downloads shy of the #2 slot.

Behind the surge is a distribution machine that already lives on Indian phones. Kuku TV launched in late 2024 as a sister product to audio giant Kuku FM (which reported 4.5 million active paid subscribers), and it benefits from steady cross-promotion. Meanwhile, QuickTV rides the massive social footprint of parent Mohalla Tech (ShareChat + Moj), which claims 325 million monthly active users across its platforms. In the last 2–3 months alone, ~150 million users watched short-drama content on Moj and QuickTV, and daily episode views topped 100 million, according to the company.

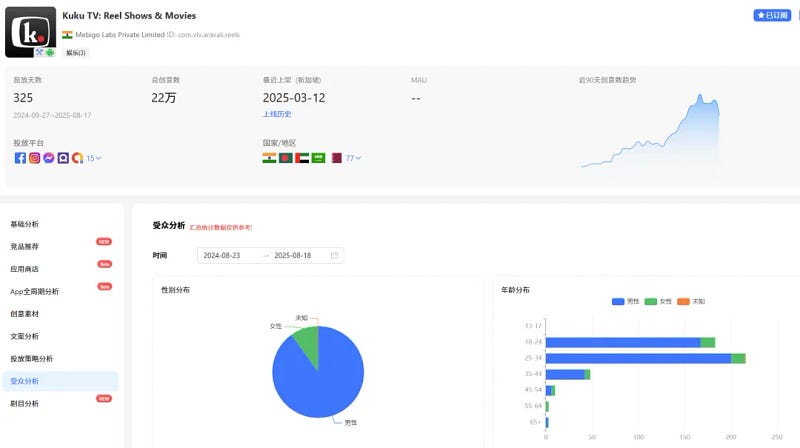

The scale shows up in app-level numbers too: Kuku TV has amassed 12.72 million cumulative downloads; QuickTV sits at 8.48 million.

The fuel: phones, habits, and fresh capital

India is already the world’s second-largest smartphone market. Users spend 4–5 hours a day on their phones, much of it on video and social, and mobile viewing is entrenched even in rural areas via 4G. That’s exactly the context where short, swipable narratives thrive. Investors have noticed: funding into India’s short-drama OTTs has reached ~$44 million so far in 2025, up 57% from 2024, including a single $5 million round in July. Legacy OTTs are moving too: Zee (with Bullet), Amazon’s MX Player (MX Fatafat), and Jio Hotstar all say they’re building short-drama rails.

What people are actually watching

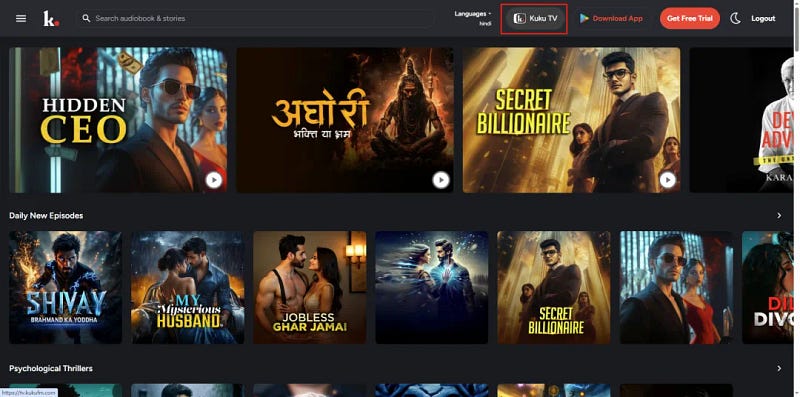

Here’s the twist: on Kuku TV’s home page, featured rows, and trending charts, translated series dominate. In one snapshot, nine of the top ten were translations; only the #1 slot was a local original. Executives working with multiple Indian platforms say Chinese short dramas, localized into Indian languages, perform best thanks to mature story engines, fast “hook” design, and genre fit, particularly male-targeted formats and even some costume/fantasy fare.

That doesn’t mean local hits don’t exist. One Kuku TV original pulled 3+ million plays in-app, a 4.7/5 rating, and 1+ million plays across three YouTube uploads. But those are still exceptions against a translation-heavy leaderboard.

The wall: monetization that won’t budge (yet)

Despite the download fireworks, revenue is thin. Industry advisors point to three structural limits: low ad CPMs in India, subscription models that don’t perform well for ultra-short video, and in-app purchases that haven’t scaled. Data from leading platforms underlines the problem: of the top four, three reported no revenue to date, and even “#1” Kuku TV shows just $0.031 revenue per download (RPD). One executive estimates you’d need at least 10 million subscribers to make an ad-supported model truly attractive to brands.

Audience mix compounds it. Although male and female-targeted shows have similar shelf space, Kuku TV’s user profile skews 90%+ male, which means a big chunk of potential spending power, women, isn’t yet activated on these apps. Until platforms broaden the base (and the advertiser categories that follow), every monetization lever stays underpowered.

Why local production lags, and why platforms import

There’s a production gap. Writers and producers are still building muscle on short-form “hook” craft and genre pipelines, so many local stories fall back on a narrow set of templates. Budgets are tighter still: typical costs land between ₹150,000–₹500,000 per series (about $1,716–$5,720). Producers joke they’re being asked for “China-level quality at India-level budgets.” Given that math, platforms often prefer buying polished Chinese series and dubbing them, because the viewership is more predictable for the same spend.

What has to change for India’s apps to work as businesses

Build fewer, better local tentpoles. Keep licensing translations for volume, but carve out real budgets for a slate of local “must-watch” series that can anchor marketing, raise ARPU, and travel across languages later. The market’s phone-first habits are there; the local IP needs to catch up.

Fix the funnel economics. If subs won’t carry shorts alone, mix models: broader free tiers to grow reach; small, impulse-price “micro-unlocks” for endings or bonus arcs; bundles with sister apps (audio, social) where the user already pays. Platforms are already experimenting with free-trial-to-sub conversions, double down with clearer value ladders.

Court women explicitly. A 90%-male user base limits both content categories and advertisers (beauty, household, parenting, finance). Commission female-lead revenge/competence fantasies, modern romance-mystery hybrids, and work-life dramas tailored for mobile pacing. The payoff is not just installs; it’s monetizable attention.

Upgrade the ad story. To overcome low CPMs, sell what short drama is uniquely good at: completion rates on micro-arcs, frequent cliffhangers that reset attention, and shoppable hooks embedded between episodes. But brand buyers want scale; that 10M-subscriber threshold isn’t optional, so cross-app alliances or syndication inside big OTTs can accelerate reach.

Use capital to de-risk craft. The money is arriving; spend some of it on writers’ rooms that prototype “hook maps” and on production playbooks that compress costs without killing quality. A few repeatable series engines can lift the whole library’s baseline.

India has the audience, the rails, and now the capital. What it doesn’t yet have is a monetization engine and enough premium local IP to match its download momentum. Until budgets rise for flagship originals, user demographics diversify, and ad/sub hybrids get sharper, India’s short-drama apps will keep topping the charts, with pockets that still feel empty.