Vertical Dramas Go Global — The 2025 Power Map

The Market Blows Past $700 Million in a Quarter

The Market Blows Past $700 Million in a Quarter

Mobile users poured almost US $700 million into in-app purchases for vertical-drama apps in Q1 2025, nearly 4× the spend a year earlier; downloads jumped to 370 million installs. The surge is no longer a China-only story: Latin America, Southeast Asia, India and the United States all supplied double-digit growth. ↗

Twin Titans Hold the High Ground

ReelShort and DramaBox still sit comfortably on the throne. In the first quarter the two platforms logged US $130 million and US $120 million in IAP revenue, together controlling ≈ 70 % of global spend. Their cumulative lifetime take has already crossed US $4.5 billion. Both keep doubling-down on an America-first + IP-revamp playbook: almost half of their revenue still comes from the United States, where they feed loyalty with locally produced originals.

China’s Second Wave Charges Up the Charts

A phalanx of new Chinese exporters is snapping at the leaders’ heels. DramaWave exploded more than 10-fold in Q1 downloads, topping the global growth chart; analysts peg its revenue run-rate at ≈ US $120 million.

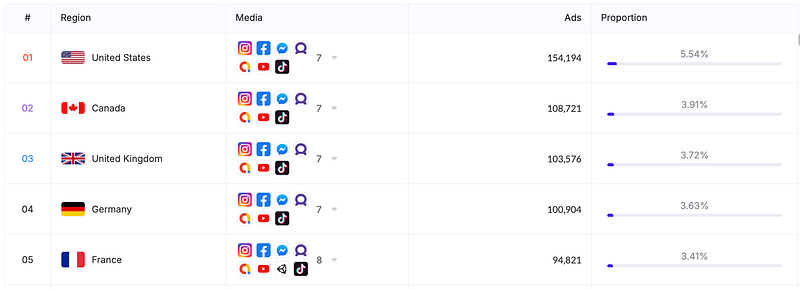

Geographically, DramaWave targets mature Western markets. According to AppGrowing, its top five ad destinations are the United States, Canada, the UK, Germany, and France:

FlickReels, backed by mobile-game house Zhangwan, lifted quarterly income +375 % thanks to “Web-to-App” landing pages and silver-age melodramas. Minishorts, from ByteDance’s book division, quietly cracked the U.S. top-ten IAP chart with an ad-plus-coins model.

Mini-app specialists such as Stardust TV and NetShort transplant their vast catalogues of translated Chinese hits, then test-bed local originals to capture share.

Stardust TV leverages thousands of ready-made Chinese episodes as a cash-flow bedrock while promising 50–100 fresh local series per month. NetShort hits ad boards harder than any rival, routinely topping DataEye’s UA charts, and FlickReels slices markets by age: flamboyant billionaire feuds for Gen X in the West, Cinderella revenge for Gen Z in Southeast Asia. The strategy is quantity first, AIGC dubbed and re-skinned, then a steady crawl toward higher-quality originals.

Local Contenders Enter the Arena

Vertical drama is no longer an all-China export.

- My Drama (Ukraine) marries AI script generation with interactive characters. Founder Bogdan Nesvit says the studio already pushes thirty-minute coherent narratives and aims to let viewers chat with on-screen protagonists in real time.

- Vigloo (Korea) launched out of audio giant Spoon Radio and secured an US $89 million investment from PUBG publisher Krafton to bankroll 100+ English originals. Romance and revenge K-dramas now account for half of the app’s U.S. revenue.

- Kuku TV (India) converts the 40-million user base of Kuku FM into vertical-video binge-ers. It courts 25- to 34-year-old men with male-power fantasies, subscription-only access, and seven Indian-language feeds, topping Google Play downloads in April with 10 million installs.

These home-grown challengers prove the format can be rebuilt on local culture rather than dubbed Chinese scripts.

The Free Model Wild Card

ByteDance opened a new front with Minishorts (U.S./Europe) and Melolo (Indonesia, Philippines). Both offer limited free episodes, then gate progress behind ad views, daily coin tasks, or a pricey US $15 weekly pass. Early App-Store reviews applaud the library but slam the cost: unlocking a 50-episode saga can run ≈ US $25, higher than Disney+’s monthly fee. Still, the combo of TikTok-scale ad reach and hyper-price-sensitive regions makes the “freemium + whale” calculus worth watching.

What the New Map Means

The 2025 landscape is a three-tier cage match: Chinese titans defending U.S. revenue pools; second-wave exporters racing to carve niches; and native startups weaponizing local culture, AI workflows or free-to-watch funnels. For creators that translates into many more buyers hungry for differentiated IP. For investors it means a near-term land-grab, platform burn rates are accelerating as user-acquisition CPMs rise. And for Hollywood? The longer it waits, the harder it will be to unseat winners whose audience, pricing psychology and data loops are already regionalized.